are campaign contributions tax deductible in 2019

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Many believe this rumor to be true but contrary to popular belief the answer is no.

Are My Donations Tax Deductible Actblue Support

Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor.

. Unutilizedexcess campaign funds that is campaign contributions net of the candidates campaign expenditures will be considered subject to income tax and as such must be included in the candidates taxable income as stated in his or her income tax return filed for the subject taxable year. Taxpayers can file their 2019 tax return now and claim the deduction before the contribution is actually made. Heres how the tax credit works.

The answer is no political contributions are not tax deductible. 501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious. Learn how campaign contributions can be used when an election is over.

The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. The 2019-2020 contribution limit was capped at 2800. The irs explicitly says that contributions to political campaigns and candidates are not tax.

According to the Internal Service Review IRS The IRS Publication 529states. Many believe this rumor to be true but contrary to popular belief the answer is no. Are charitable contributions deductible in 2019.

The answer is no political contributions are not tax deductible. Its only natural to wonder if donations to a political campaign are tax deductible too. We all know that donations to charity are tax deductible.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. As circularized in Revenue Memorandum Circular 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing such. Qualified contributions are not subject to this limitation.

Are Political Contributions Tax Deductible Related Articles. Contributions are deductible on your tax return in years when you are younger than 705 and you or your spouse earned taxable income. The bottom line is if you dont itemize and take the standard deduction you cant deduct charitable donations.

For many people the tax break from Uncle Sam is almost as big a motivating factor as altruism. According to the Internal Service Review IRS The IRS Publication 529 states. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Contributions or gifts to the peoples campaign are not tax deductible. Learn how campaign contributions can be used when an election is over. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

Learn how to maximize your impact with a Schwab Charitable donor-advised fund. You cannot deduct expenses in support of any candidate. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

For 2019 the standard deduction is 12200 for single filers and 24400 for joint filers. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. But the federal tax code doesnt allow you to take a deduction for any political donations you make. This stems from the presumption that campaign contributions are meant to be utilized by the candidate for his or her campaign and not for personal use and are thus not a proper inclusion to the candidates taxable income.

Are campaign contributions tax deductible in 2019. WASHINGTON The Internal Revenue Service today reminded people that contributions to traditional Individual Retirement Arrangements IRAs made by the postponed tax return due date of July 15 2020 are deductible on a 2019 tax return. Many believe this rumor to be true but contrary to popular belief the answer is no.

Are campaign contributions tax deductible in 2019. As a result you may not itemize deductions this year even if youve consistently done so in the past.

Free 8 Sample Pledge Forms In Pdf Ms Word Pledge Lesson Plan Template Free Card Template

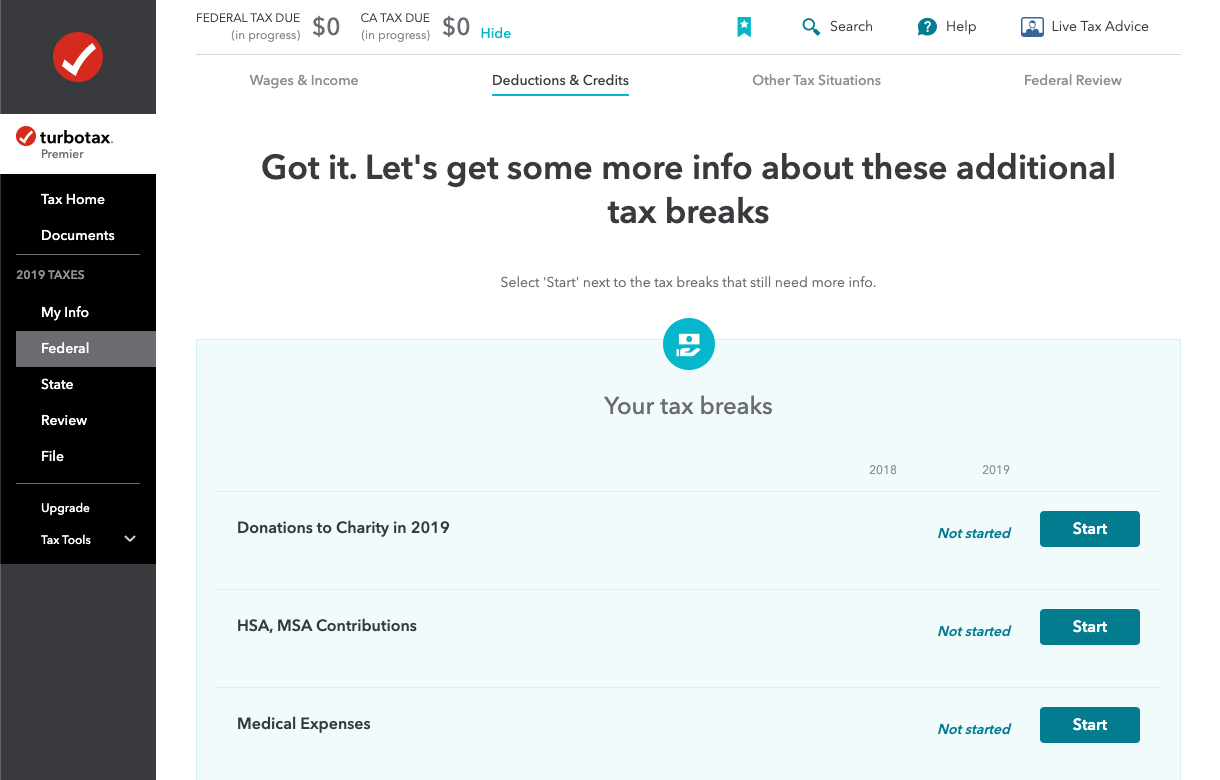

Are Contributions To Nonprofit Schools Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible H R Block

Biloxi Bay Chamber Spotlights Health And Wellness Check It Out Bbacc Biloxibayareachamber Supportea Health And Wellness Family Dentistry General Dentistry

Cee Index Of Excellence In Stem Education Stem Education Education Excellence

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Best Donation Cards Template Card Templates Free Card Templates Printable Card Template

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

How Much Should You Donate To Charity District Capital

Charity Organisation Charity Organisation Jobs Apps

How To Write Off Donations On Taxes Gobankingrates

Are Political Donations Tax Deductible Credit Karma

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible H R Block

Benefits Of Donating Fine Art And Collectibles To Charity Schwab Charitable Donor Advised Fund Schwab Charitable

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog